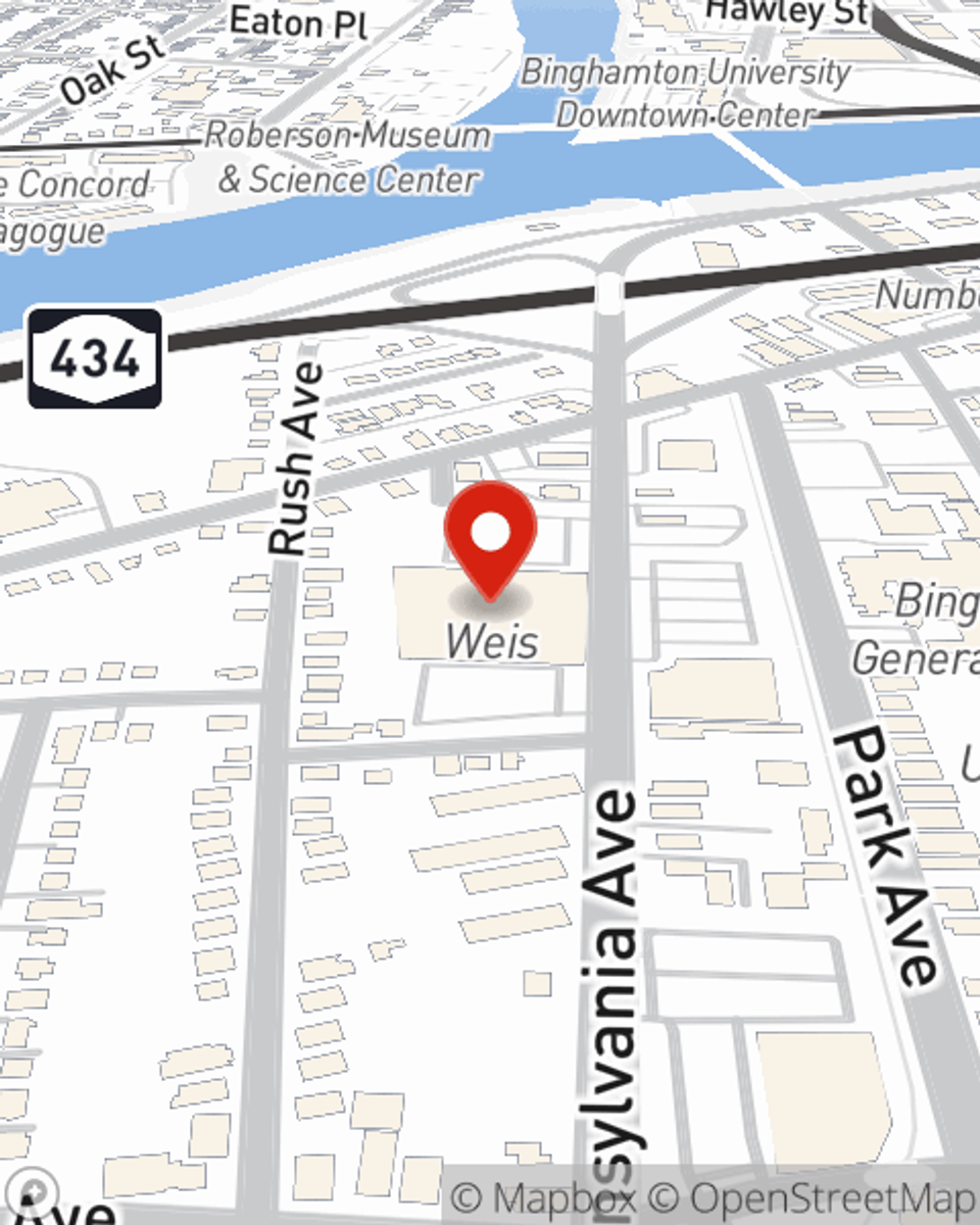

Life Insurance in and around Binghamton

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- New York State

- Binghamton

- Vestal

- Johnson City

- Endwell

- Endicott

- Kirkwood

- Conklin

- Windsor

- Chenango Bridge

- Chenango Forks

- Port Crane

- Maine

- Apalachin

- Owego

- Harpursville

- Nineveh

- Whitney Point

- Broome County

- Tioga County

Protect Those You Love Most

People choose life insurance for a variety of reasons, but the main purpose is typically the same: to protect the financial future for the people you're closest to after you're gone.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Love Well With Life Insurance

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Mark Anderson is here to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Reach out to State Farm Agent Mark Anderson today to experience how the trusted name for life insurance can protect your loved ones here in Binghamton, NY.

Have More Questions About Life Insurance?

Call Mark at (607) 724-2886 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Mark Anderson

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.